We have previously covered savings accounts, for long term savings. In this article, we highlight Regular Saver Investment accounts as they are very attractive and easy to set up.

To get started, simply follow these steps:

- Set up a Direct Debit amount and date.

- Choose your investment fund or funds.

- Your monthly savings go into your account and are invested into your chosen fund.

What are they?

Accounts aimed at providing savers with growth on their money, beyond what is available on deposit with banks & credit unions.

This is not investing to ‘get rich’. This is investing to get slow and steady growth on your savings over time.

The Funds

All large pension and savings companies offer Regular Saver Investment accounts, and they all offer a range of funds for savers to choose from. What ‘the fund’ is doing, is pooling the money of like-minded savers, and investing it across a wide range of shares & bonds, across a wide range of companies & countries, to achieve a targeted range of growth.

Taking Zurich for example, as we like their funds. They have funds targeting a lower, more conservative return, and more aggressive funds targeting higher returns each year. The trade-off for trying to achieve a higher return is that in years when economies & markets perform poorly, the drop in your investment will be larger than in a more conservative fund choice.

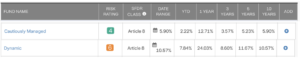

To simplify it, there is a rating system of 1-7, 1 being the most conservative and 7 being the most aggressive. Each fund rating will indicate the range it is aiming to operate within. Below is an example with Zurich:

You can see that one has a rating of 4, and the other 6. Over 3 years ‘Cautiously Managed’ has achieved an average annual return of 3.57% vs 8.6% in the ‘Dynamic Fund’. Over 10 years it is an average annual return of 5.9% & 10.57% respectively.

When you look at the individual years (below), you see the trade-off…. While the Dynamic Fund gains more on average each year than the Cautiously Managed Fund, the negative years are worse. The fund falls in value by more in poor performing years, vs a more conservative equivalent. Historically on markets, 1 in 5 years on average are negative performing years.

How To Choose One?

This is where your advisor / broker comes in. They will help to ascertain your ability and appetite for investment risk, along with your savings objectives and recommend a suitable fund. You then need to review your situation every year to see what has changed, how the account is doing and make any changes necessary, due to changes in your circumstances etc.

Accessibility

You can cash in your investment account in part or in full whenever you wish, however as they are designed for long term saving, there are penalties for withdrawing your money in the first 3 years. 3% in year 1, 2% in year 2 and 1% in year 3. After that there are no charges or penalties for withdrawals. On requesting your money it will usually be sent to you in 7-10 days. You have the choice of taking back the full balance or just withdrawing some of the money.

_________

Here to help you save for today, tomorrow and for the unexpected.

At Lynx Financial Services, our team of experienced financial advisors are dedicated to helping you achieve your financial goals. We understand that everyone’s circumstances are unique, and we take a personalised approach to financial planning.

We’ll work with you to assess your needs, risk tolerance, and investment goals, and develop a tailored plan to secure your financial future. Let us help you navigate the complexities of financial planning and make informed decisions about your retirement income. No jargon, no hidden fees, just plain talking, strategic financial advice.